Business rules and logic play a critical role in the efficient operation of an organization. They set expectations, provide guidelines on work performance, ensure compliance, and help organizations automate their processes.

In this article, we will look at 10 common business rules examples to illustrate their potential real-world applications.

What are business rules?

Business rules are directives that define an organization’s business activities. They are important because they clarify an organization’s objectives and detail how processes will be performed. Business rules can be informal, written, or automated.

When it comes to automating rules, a business rules management system (BRMS) plays an incredibly important role. A BRMS is a software solution that is used to define, deploy, execute, monitor, and manage business rules. There are a broad range of business rules systems available, but they all have three key components.

First, business rules are stored in a repository. A repository is a database infrastructure that collects, manages, and stores data rather than embedding rules within an application’s code. Second, a BRMS provides easy to use development tools that allow users to define and manage business rules without the need to write code.

Finally, a runtime environment allows applications to invoke the applicable business rules and execute them using a business rules engine. Note that a business rules engine can also be purchased independently of a BRMS.

Organizations that stand to benefit from a BRMS include:

- Organizations that are governed by defined business rules or internal policies.

- Organizations seeking to improve efficiency while making more informed decisions.

- Organizations that are concerned about compliance issues and want to reduce the possibility of legal and regulatory actions.

- Organizations that prioritize flexibility to adapt to changing market conditions.

Common business rules examples

Customer discount rules

Business rules are commonly used to offer customers discounts. For example, an organization may have a policy to give customers that spend $5,000 in a calendar year a discount on purchases once that threshold is reached. The rule could be: “If a customer spends more than $5,000 in any calendar year, then offer a 15% discount on each item.”

Subscription service auto-suspension

Subscription fee models are common in nearly every industry. Yet manually managing subscription billing and service eats away at your bottom line. To make it easy, may automate suspension of service for nonpayment. So, an organization could create a business rule that cancels service for any customer that fails to make a payment (i.e., more than 30 days past due).

Automated sales commissions

Many employees are compensated on a commission basis or awarded bonuses based on performance. To simplify the process, accounting might create a rule that: “If an employee sells more than $50,000 worth of products within a calendar year, he or she will be awarded a $5,000 bonus.” This rule ensures that an employee is paid as agreed without the need to manually track sales.

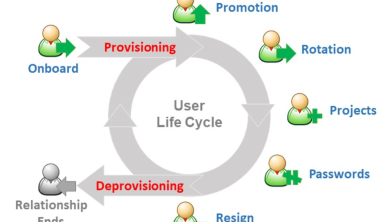

Assigning assets to new employees

Employee onboarding is a time-consuming process. Employees must be trained, granted system access, and assigned assets, among other things. An example of a common onboarding business rule might be that all new employees are assigned an email address. Credentials would be automatically created allowing the employee to access the system and choose a new password.

Home loan interest rate business rules

Banks are required to collect a lot of data when originating a mortgage, like information about the home being purchased and the borrower’s credit history. Business logic plays an important role in automating manual loan processes. For instance, a bank can specify a minimum credit score to qualify for a specific interest rate.

Suspicious transaction triggers

To mitigate fraud financial institutions rely on automation to flag suspicious transactions. With these rules, banks can specify charges that trigger authentication. For example, out-of-state credit card transactions over $1,000 could require that a representative contact the cardholder to verify the transaction.

Generating student ID numbers

Admissions Offices are also tasked with collecting and reviewing a lot of information. Business rules can help streamline the application process as well as enrollment. For example, once a student is accepted the system can automatically generate student ID numbers. Rules could determine both the prefix and the required number of characters.

Declined applications based on scores

Landlords and property management companies are tasked with reviewing rental applications. Creating rules to approve or reject applications can streamline the process. For instance, an organization could create a rule that declines a rental application for an applicant with a credit score lower than a specified threshold.

Auto calculating shipping rates

Clearly defining shipping rates helps organizations to provide good customer service and ensure that each sale is profitable. Business logic is commonly used to calculate rates. For example, “The basic rate is $2 per pound but is reduced to $1.50 per pound for excess over 10 pounds.”

Purchase requests by amount

Manual approval processes are inefficient and often lead to delays while employees chase down supervisors for signatures. With a BRMS, an organization might automatically approve purchase requests under a certain amount, say $2,000. For purchase requests over $2,000, the rule may require that the request is reviewed by a supervisor.

Via processmaker